In our ever-present quest to read the tea leaves for candidates who are attempting to time their moves to Asia to maximize the development of their skills while not “missing the boat”, one place we always want to look is the IPO market.

Current IPO market sentiment in China is slightly gloomy, but the headlines bounce from gloom to vroom on an almost daily basis when there is a market downturn. A cursory check of recent headlines from major news outlets reveals some of the gloomy headlines and “bad facts” being thrown around:

Current IPO market sentiment in China is slightly gloomy, but the headlines bounce from gloom to vroom on an almost daily basis when there is a market downturn. A cursory check of recent headlines from major news outlets reveals some of the gloomy headlines and “bad facts” being thrown around:

- Shares of almost two-thirds of the companies that have gone public in Hong Kong this year are now trading below their IPO offer prices

- Hong Kong Land Auction Ends Far Below Forecast

- Market Turmoil Casts Doubt Over More than US$19 Billion Hong Kong IPO Deals

But look at these countervailing facts and headlines, also all reported in the last month:

- Nine new listing candidates plan to raise a total of about HK$50 billion ($6.43 billion) in the Next Two Weeks (SING TAO DAILY)

- Hong Kong’s second quarter GNP up 11.1%

- Jewelry retailer Chow Tai Fook Jewellery Co., which is controlled by billionaire Cheng Yu-tung, on Wednesday submitted the so-called A1 form with the stock exchange, the first formal step in an IPO that could raise $3 billion to $4 billion. This is a 1,400 outlet jewelry store catering to the masses. Anyone who has ever been to HK or Taiwan with eyes open has seen the place. This is not a company that gets out on the market when sentiment is terrible.

- Beijing-based Guodian Technology and Environment Group plans to raise around $1 billion in the fourth quarter.

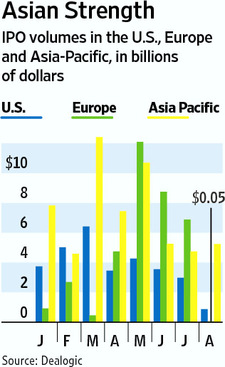

- Despite the global economic slowdown, rising market volatility and an intensifying debt crisis in Europe, Asia’s machine for initial public offerings is running on all cylinders.

- Private equity- and venture capital-backed initial public offerings in Asia have surged 77 percent in the year to date to the highest level ever.

- Hong Kong home prices are up 12 percent this year despite fiscal tightening measures meant to dampen home price growth.

Last year Hong Kong had about 95 IPO’s, including US$41 billion pushed out in the fourth quarter at (sometimes) outrageous valuations. At the beginning of the year, the banks and others were expecting the 2011 numbers to be even higher. The result? Some people have been disappointed. Anyone who expected the same craziness to continue forever was deluding himself. Impressively, the market continues to push out new IPO’s. It’s an era of “pragmatic pricing” and skepticism, but deals are getting done.

The result? Some people have been disappointed. Anyone who expected the same craziness to continue forever was deluding himself. Impressively, the market continues to push out new IPO’s. It’s an era of “pragmatic pricing” and skepticism, but deals are getting done.

Rupert Mitchell, head of Asia equity capital markets syndicate at Citigroup, summed up nicely what is clearly the situation right now (as reported in the Wall Street Journal): “China, and more broadly Asia, is the sole beacon of positive growth globally right now, so if there’s a risk dollar left in the system, it should want to play Asian equities.”

Law firms are preparing for a long term life in Asia. For anyone who has not seen it, Ben Lewis’s Asian Lawyer article, “Despite Slowdown Fears, Law Firms Taking the Long View in Asia”, sums things up nicely. Numerous firms have recruited significant additional partners and associates in recent years. Their offerings still do not match the size and depth of the market, however, and everyone anticipates that there will continue to be plenty to do for the foreseeable future.

Related Posts:

- None Found